Pag-IBIG has allowed the digital processing of loans including Calamity Loan, amid the coronavirus disease 2019 (COVID-19) threat.

According to Proclamation 929 signed by Duterte, the state of calamity is expected to last for six months unless earlier lifted or extended by the President.

With lost jobs and business operations on hold, most Filipinos are in need of financial assistance.

The Pag-IBIG Fund Calamity Loan Program "seeks to provide immediate financial aid to affected members in calamity-stricken areas."

On their Facebook page, Pag-IBIG released an updated guide on how Filipinos can apply for a Calamity Loan amid the COVID-19 threat.

SAGOT SA MGA KATANUNGAN: EMAIL FILING

NG Pag-IBIG MPL AT CALAMITY LOAN

Bisitahin ang Facebook nila

Here's a guide on the updated loan application process.

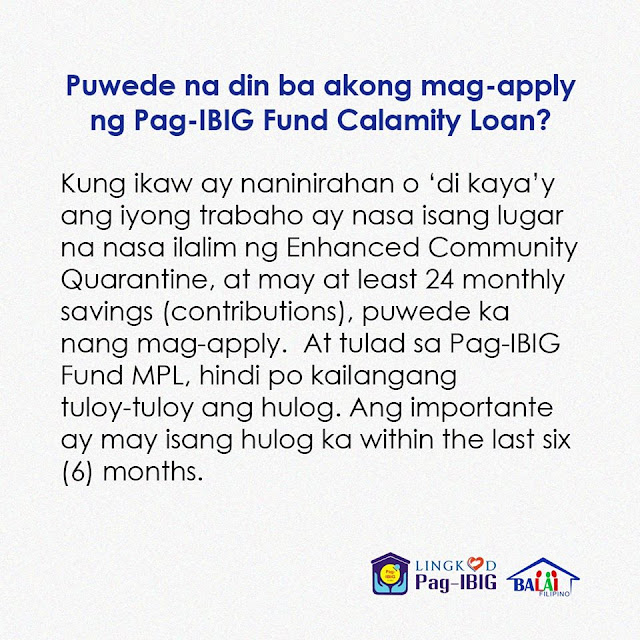

Who are qualified to apply

for a Pag-IBIG Fund Calamity Loan?

According to Pag-IBIG's website, a person must be contributing

member "residing in an area declared by the Office of the President or the

Local Sanggunian under a state of calamity."

The person should also have "at least twenty-four (24)

monthly membership savings (MS) and sufficient proof of income to

qualify."

"If you have an existing Pag-IBIG Fund Housing Loan, MPL

and/or Calamity Loan, your payments must be updated for you to qualify,"

Pag-IBIG Fund's Calamity Loan FAQ read.

How to apply for a Pag-IBIG Fund

Calamity Loan digitally?

According to the updated guide released on their Facebook page,

applicants should fill out the Calamity Loan Form.

Signatures are not required for those who are filling out their

forms digitally, but if you have printers at home, please scan or take photos the

filled out application forms and other requirements.

For those who are filling out the form digitally, make sure you

have the Adobe Acrobat Reader so you can fill out the forms digitally.

When you've filled out the form, save it as PDF and send it to

your company Human Resources (HR) department, authorized company representative

or Fund Coordinator, along with 1 valid ID and the front and back images of

your Loyalty Card Plus, or Landbank, UCPB or DBP cash card.

The company HR personnel or whoever is in charge should email

the application form along with other requirements to the Pag-IBIG Fund email

address designated for your area.

What are the requirements

for a Calamity Loan application?

The requirements to complete the Calamity Loan are as follows:

• Completely filled-out application form

• 1 valid ID

• Front and back images of your Loyalty Card Plus, or Landbank,

UCPB or DBP cash card.

First time borrowers with no Loyalty Card Plus, Landbank or DBP

Cashcard will be advised on how to best receive their loan proceeds.

How much can you borrow?

According to Pag-IBIG Fund's website, qualified applicants can

borrow up to "80% of their total Pag-IBIG Regular Savings."

"It consists of their monthly contributions, their employer’s

contributions, and accumulated dividends earned."

Meanwhile, if you have an outstanding Multi-Purpose and/or

Calamity Loan, the amount of loan you will receive is "the difference

between the 80% of your total Pag-IBIG Regular Savings and the outstanding

balance of your loan/s."

Until when can qualified

applicants borrow?

Pag-IBIG said those who are qualified can borrow "within a

period of 90 days from the declaration of a state of calamity."

How to pay and how much is

the interest rate?

According to Pag-IBIG's website, "the loan is payable

within 24 months and comes with the initial payment due on the 3rd month after

the loan release."

How will I know if my loan

has been approved?

Pag-IBIG said the "member will receive a text message that

will confirm the loan approval and crediting in the Loyalty Card Plus, LandBank

or DBP Cashcard."

Where can I email the

requirements?

Here's the list of email addresses assigned based on your office

address.